Getting a Mortgage Whilst Matched Betting

Buying a house is an exciting but nerve-racking move for anyone. You might be worried about your application being rejected. Or you might think that you could make a mistake along the way. How can you make sure getting a mortgage whilst Matched Betting goes smoothly?

Well, it is easy to find information online about the mortgage process. Your lender should also explain everything to you from the very start. Yet, there is still something that you might struggle to get information on.

What if you currently make money from matched betting? You will want to know how this affects your mortgage. Should you count this money among your income or not? Maybe you wonder if you should tell the bank about it or not.

There are a lot of questions to cover here. Let’s take a look through the whole thing, so you understand what to do.

Banks and Mortgage Brokers Don’t Like Betting

The first point to cover is that mortgage lenders don’t really like betting. It is something that makes them nervous. They might start to imagine you losing all of your money on a wild gamble.

Of course, they don’t understand matched betting. They don’t know that you aren’t really risking your money. If they see something about betting they will just fear the worst.

A lender may get nervous if you mention betting. The first thing they will imagine is that you might lose a lot of money. What if you can’t pay your mortgage because your horse loses?

There is no point in trying to explain matched betting to them. You know that you won’t ever lose money. But they are unlikely to understand or believe you. Matched betting will just sound too good to be true. So they will look at you being a higher risk.

Therefore, the simplest move is to not mention betting at all. It isn’t going to help your application anyway. The lender won’t include your earnings in your income calculation. It needs to be taxable income to be counted in a UK mortgage. Matched betting profits are tax-free, of course.

This means that all that it can do is complicate matters. If you mention the word “betting” it might put them off. So just avoid it altogether to be on the safe side. Don’t say anything about matched betting and they will assess you on the same basis as everyone else.

Does Opening Bookmaker Accounts Show Up on Your Credit Record?

The credit check carried out by banks is pretty daunting. This is when they check out your history. Your previous loans and credit card history will show up on here. If you have defaulted or paid late then this will affect your chances of getting approved.

In fact, even making an application for credit shows up on here. It is one of the things that can really mess up your application. Even a minor problem from years ago can turn into a big issue now.

This may lead you to wonder whether your betting activity will also appear. For instance, when you open a bookmaker account, is it listed on your credit score? Will the bank be able to see from this that you bet online?

The good news is that this doesn’t affect your credit history in any way. Your bookie accounts won’t show up on here. There will be absolutely nothing about your matched betting on show.

You could open accounts with every bookie and it wouldn’t matter. So don’t feel that you need to stop opening accounts. You aren’t asking the bookie for any sort of credit. So there is nothing of interest to the credit agency in this relationship.

Having said that, there is one exception. If you open spread betting accounts it will show up. Therefore, you should avoid doing this. Every other type of bookie account is fine, though.

There is no need to wait until your mortgage is approved before opening bookie accounts. You can get started whenever it suits you to do so.

How to Carry on Matched Betting

There are some good reasons for wanting to carry on matched betting. For a start, you might need some extra cash. Buying a home is hugely expensive to do these days. In fact, this period could see you under more financial strain than ever before.

Even if the mortgage is covering the full price, there are other purchases to pay for. Your new furniture, for example. Then there are the moving costs and all of the little expenses you might have missed. It all adds up to a tidy sum.

Bearing all of this in mind, some extra income can be very welcome. It isn’t a time for gambling and losing, though. Instead, you will want to make money safely with solid matched betting tactics. You are always going to come out ahead.

Then there is the stress of your mortgage application to think about. You might find this to be one of the most stressful times in your life. There is a lot to think about. There is every chance that you go to bed thinking about mortgages. And then wake up thinking about them too.

A good hobby can help you to take your mind off it for a while. In this respect, matched betting is a solid choice. It is something that is fun and lets you forget about everything else for a while.

Another point to bear in mind is that matched betting helps you to stay in and save. If you are saving for a house then you won’t want to spend money on nights out too often.

Staying at home and earning cash is a far better move. You can enjoy some great time without spending a penny. This will really help you to put away some extra money. Even just a few months of this routine can prove to be a huge help.

Therefore, there is no need to stop matched betting at this time. Or even to have a short break. If you have the time for it then carry on as before. You might even decide to dedicate more time to making money in this way.

On the other hand, you might be short of time for this. With so much to do, you could struggle to carry on matched betting. In this case, there is no harm in taking a short break. It all depends on your circumstances.

Keep Your Statements Clean for 3 Months

You will be asked to provide bank statements for your bank or broker to assess. This is normally for a 3 month period. However, if you are self-employed or have unusual circumstances they might need more. Usually, online statements are fine for banks if they are printed off.

They will want to assess these statements carefully. The bank will look here for any signs of unusual activity. They need to be sure that you aren’t hiding anything from them.

So you really need them to be clean, with absolutely nothing out of the ordinary on them. This means making sure that no gambling transactions show up. Even though you know that matched betting is safe, banks will get nervous about seeing bookies.

If the lender sees the name of a betting firm it will be a red flag to them. Because of this, you should avoid using your main account for matched betting transactions. Just make sure that nothing related to gambling shows up on here.

You only need to show statements for your main account. This means that you can use a different bank account or e-wallet for your betting. Bear in mind that it shouldn’t be an account with the bank giving you a mortgage. They could easily see the statements in this case.

You will also want to avoid moving money between the different accounts. If they can see money going to another account they will ask for statements for that account too. Keep it totally separate to avoid any problems.

The following are some of the best options to bear in mind. Choose the one that you prefer. Obviously, you can use more than one if you like.

- You can use accounts with the likes of PayPal, Skrill or Neteller. Most bookies accept all of these methods with no problem. Just check their payment and withdrawal methods before starting.

- Alternatively, you could choose to open a prepaid card. This is something that doesn’t show up on your credit score. Neither are you required to show the details to lenders. So it is completely safe to use.

If you currently use your main account then it is time to switch. Be sure to do this in time. You will need to gather three months of statements with no gambling transactions on them. Don’t leave it too late to make this move.

Made a Lot of Money Matched Betting

Have you been very successful at matched betting? If so, this is terrific news. You can win a lot of money in this way over time. In what ways might it affect your mortgage application, though?

You might want to use these winning as your deposit for a house. Maybe they will allow you to get a bigger house than you had thought. Or else you could ask for a lower mortgage.

Having some extra cash to use can give you a lot of added flexibility. This is more important when buying a house than ever before. It can help you to deal with unexpected changes and hitches as well.

Might using a large lump of money to your deposit cause any problems? You certainly will need to declare where it comes from. Let your solicitor know where you got this money from. This means that they know it is all above board and legal.

An alternative approach is to put it in your main bank account. You can then wait at least 3 months before applying for a mortgage. At this point, you can simply call this cash savings.

Since the bank won’t ask for older statements, they won’t know when you deposited it. If you have time on your side then this is the best move you can make. It also enhances your chances of being accepted. Your main account will look great with this extra cash sitting on the balance.

Remember that these profits are tax-free too, In fact, they can be perfect if you are saving for a mortgage. Some matched betting income can be just what you need.

Let’s imagine that you plan to buy your first house in a year or two. How big a difference could this type of income make? Well, you could fairly easily pick up £500 each month doing it.

This works out as £6,000 in a year or £12,000 over a couple of years. This sort of money could be vital in getting your mortgage. For instance, the higher your deposit the better your options are going to be.

Adding this sum onto your deposit might get you a better interest rate. Or it might make the difference in getting approved or not. Either way, it makes sense to build up some winnings in advance.

If you are planning on buying a house it is a good time to start. Since you win with no risk, it is ideal for building up savings. Work out when you plan to apply for a mortgage and then start winning money.

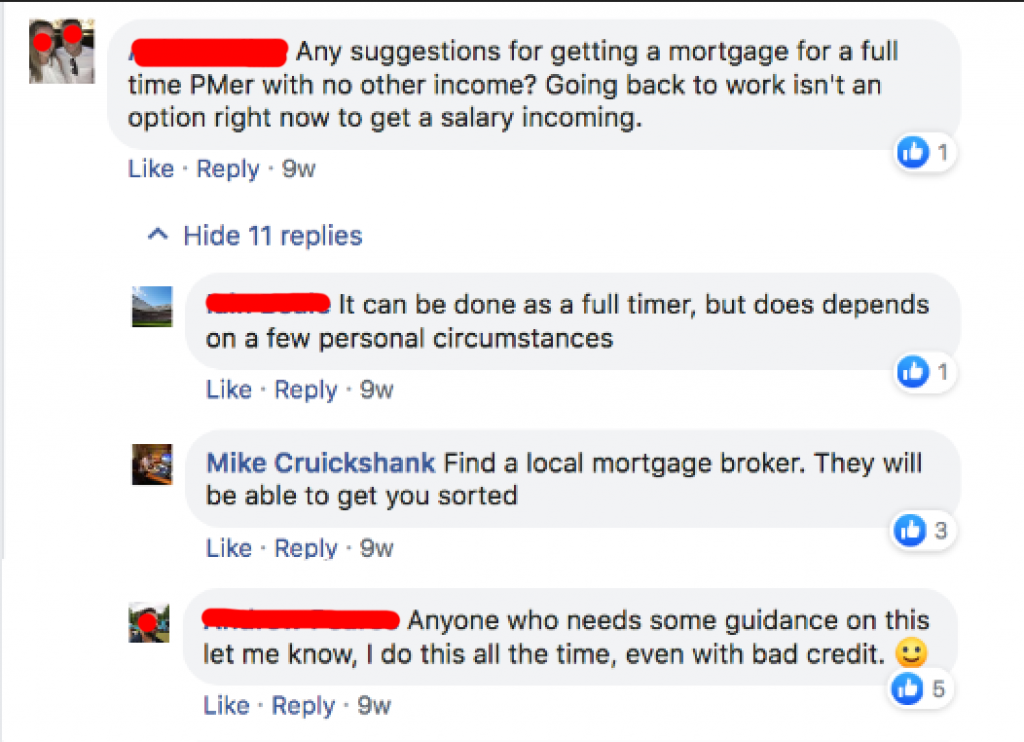

As a Full Timer Can I Get a Mortgage?

A lot of people use matched betting as a way of getting an extra income. If you have a full time job this makes sense. We could all do with a bit of extra money each month, after all.

By spending some time matched betting, you can do this pretty easily. It is a great feeling to see more money roll into your account. There is also no risk of blowing your savings in this way. Just follow the rules and you will be fine.

Yet, there is also another possible situation. You may be earning from matched betting full time. There are a number of reasons why this could be the case. Maybe you lost your main job or perhaps you just prefer the freedom of matched betting.

Many people have discovered that this can be done. If you put in enough time you can earn a good income. It also gives you a highly flexible way of working from home.

Anyway, the big question is whether you can still get a mortgage. As we saw earlier, it is best not to mention gambling to your bank. However, in this case you won’t have any choice in the matter. If you don’t mention matched betting you will have no income to declare.

The truth is that your bank is unlikely to approve your mortgage. That is, unless you have a top-class relationship with them and other assets. For most people, it is simply a no-go. Banks don’t like to take risks. There is no doubt that they would see this as being a risk.

Another option is to ask someone to be a guarantor for you. This is something that people might ask their parents to do. What this means is that the mortgage is based on their income. So, you need to remember that they are putting their neck on the line for you.

Perhaps the best option is to contact a mortgage broker. They will have plenty of contacts with numerous different lenders. So they will know who is most likely to accept you.

Mortgage brokers can get all sorts of cases accepted. Even if it looks impossible at first sight. People often approach them if they have poor credit or some other problem. This means that they are used to resolving difficult situations and unusual cases.

Simply explain your situation to a mortgage broker. They will then let you know what your options are. Naturally, you might need to speak to a few brokers before you find a good solution. In fact, it could take some time to find the right broker for your needs.

Matched betting forums are an ideal place to find a broker that can help you.

It is also a good idea to speak to others who carry out matched betting on a full time basis. This can be done on an internet forum or group. Find out how other people in your situation got it sorted out. You might even receive a recommendation from someone who was once in exactly the same position.

Conclusion

For a lot of people, matched betting will have no real impact on their mortgage. If you have a full time job then this extra income can just stay out of sight. This means that it won’t cause any problems for you.

However, there are some points to bear in mind. These include where your winnings go and when to take a break. The most important point is around finding a mortgage when you do this full time.

There is nothing in matched betting to stop you from getting a mortgage arranged. Once you understand the most important issues you are ready to go.

As somebody who works for a lender, I can tell you that they may not be able to see bookie accounts on a credit report, but they can see ALL Bank & Building Society accounts you hold. If there is a balance in there, they may well ask for statements of this account to check conduct. You won’t believe how many open a new account which they keep in perfect order, leaving their torrid spending spree / gambling evidence on another account.

I am not saying ALL lenders will ask for statements of any additional current accounts you hold, but SOME MAY. Keep this in mind so as not to be totally surprised IF statements for other current accounts get asked for.

A lender offering a mega-cheap deal will only want the creme-de-la-creme of applicants, and will actively look for a reason to not lend to those who might be the slightest risk.

Likewise, if you have not been the best with your finances and have CCJs / Defaults / Arrears, and need to use a specialist lender, they will tend to ask more questions, as they are willing to consider you as a higher risk already.

Mike’s article is fantastic, but I felt adding a little industry knowledge here may supplement his already super narrative. Getting a mortgage whilst MB’ing is possible, it needs a broker with a creative mind, and a lender that’s not too fussy.

Great article Mike, as someone who is/has been working in the Financial Services Industry for many years I would endorse using a broker over going direct to any bank. You will get a much more personalised service rather than have someone trying to sell you a product/mortgage that may not be suitable or offer the best deal in the market. A broker would also pretty much re-iterate the laying off matched betting on your main bank account. Three months is no time and MB/Casinos won’t go away